Life Insurance in and around Palmdale

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

State Farm understands your desire to protect your family after you pass away. That's why we offer terrific Life insurance coverage options and reliable empathetic service to help you choose a policy that fits your needs.

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Their Future Is Safe With State Farm

When it comes to deciding on your Life insurance coverage, State Farm can help. Agent Ricardo Cabrera can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include the age you are now, your health status, and sometimes even family medical history. By being aware of these elements, your agent can help make sure that you get a personalized policy for you and your loved ones based on your particular situation and needs.

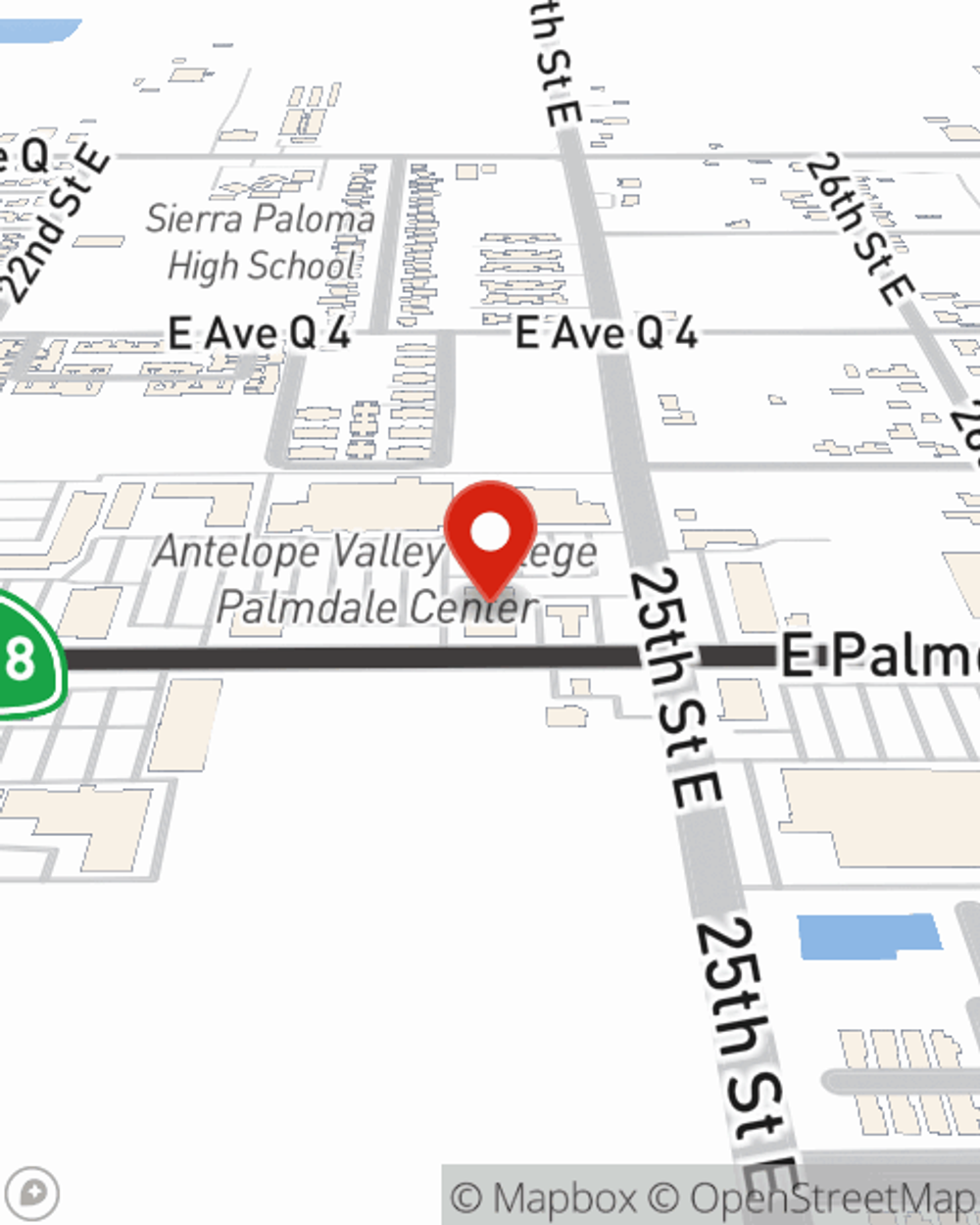

Contact State Farm Agent Ricardo Cabrera today to learn more about how the leading provider of life insurance can help you rest easy here in Palmdale, CA.

Have More Questions About Life Insurance?

Call Ricardo at (661) 349-7952 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Ricardo Cabrera

State Farm® Insurance AgentSimple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.